The money factor is a value you can get from the dealer, or you can divide prevailing new auto loan rates by 24 to use a very rough estimate. The amount of savings, however, depends on some factors, such as the residual value of the car you intend to purchase, the amount of money you pay up front (often called a capitalized cost reduction), and the cost of financing (money factor). This view is a great way to see the amount of savings that leasing may provide.

SHOULD I LEASE OR BUY A CAR CALCULATOR HOW TO

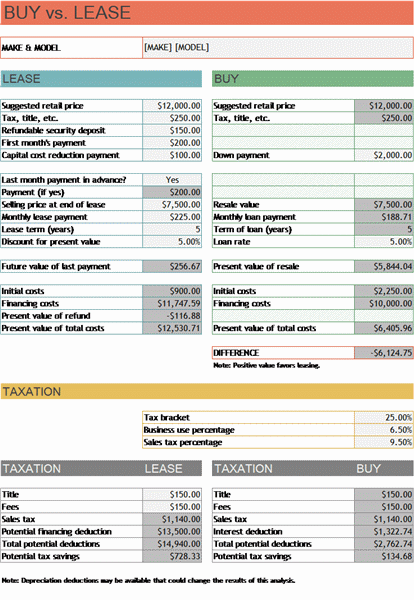

HOW TO USE OUR CAR LEASE VS PURCHASE CALCULATORĪs you change the values on the left, the calculator will show on the right side the difference between the purchase and lease options. This is because you only pay for the use of the car for two or three years, instead of paying for the vehicle itself. Thankfully, this car cost calculator makes it easy to figure the true cost of car ownership and even compare costs between different vehicles by applying all relevant factors including tax. Down Payment/Drive-Off Fee/Capitalized Cost. Similarly, your car costs can vary dramatically from vehicle to vehicle depending on whether you buy used, or new, expected maintenance, and much more. Keep in mind that with a lease, you will have to return the vehicle at the end of the lease term, whereas if you buy, you will own the vehicle and will be able to continue driving it after the term expires. In a nutshell, leasing makes it easier to get more car for less money. How to Calculate a Lease Price of the Car - the total amount the dealership is charging for this vehicle. A lease will usually look like a more attractive option when compared to a vehicle purchase when measured over a comparable term as you are only financing the amount of vehicle you “use” during the lease term.

0 kommentar(er)

0 kommentar(er)